THE CHASM

Crypto is a niche industry. Bitcoin and Ethereum are niche assets. Everything else is even more irrelevant.

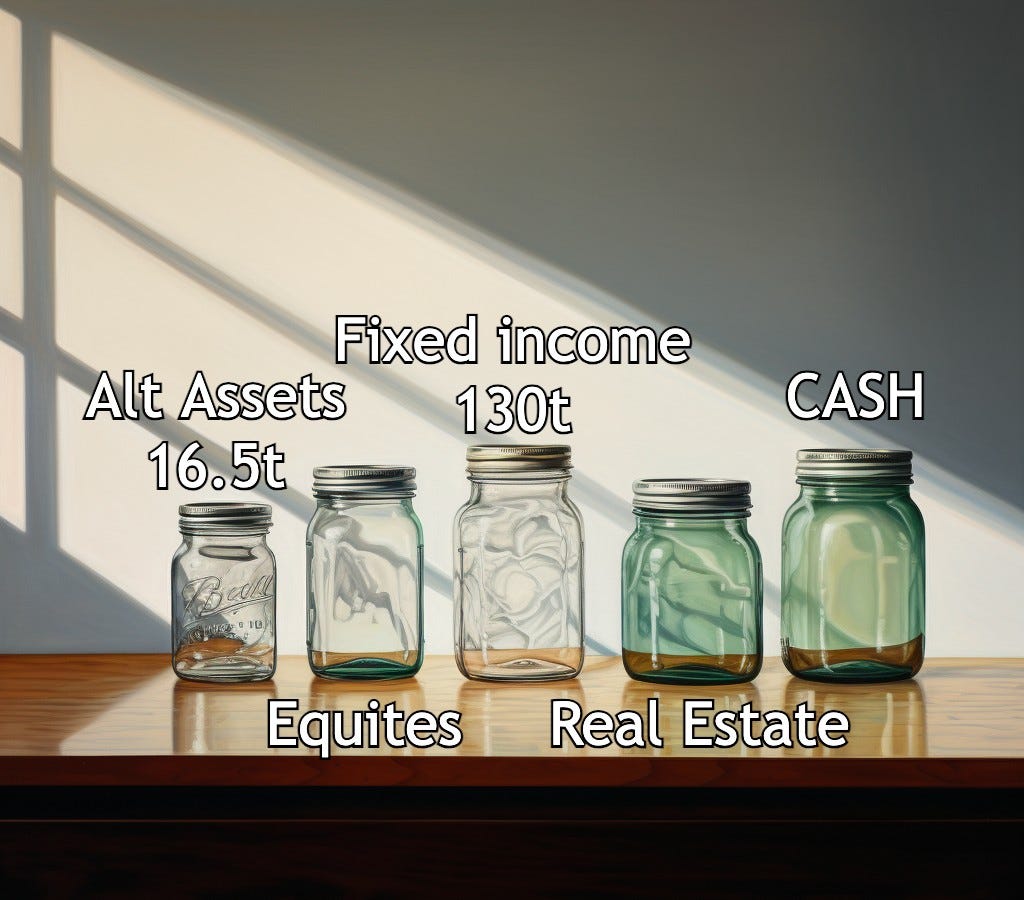

I view asset investing, at the absolute highest level, as multiple different categories competing for capital flows. I view these as Fixed income, Equities, Real estate, CASH, and ALTERNATIVE INVESTMENTS. There is a finite amount of capital that is being allocated amongst these 5 classes, and their goal is to attract the highest amount of this capital.

BTC/CRYPTO currently sits as niche assets within the alternative asset class. We’ve never had a true bull market as a relevant asset class that real capital actually looked to allocate to. We’ve always just been viewed as an highly speculative casino that only far out risk curve capital is interested in. Bitcoin finally has the chance to cross this chasm becoming an LINDY MAINSTREAM asset which can compete for real flow.

This is BITCOINs chance to become a mainstream asset class, not entirely cryptos. This will bring multitudes more eyes to the industry than before, that will come here to build and (scam). It will increase the chance drastically for the rest of the industry to reach mainstream, but it’s not guaranteed.

Ok - look

To put simply

NICHE ASSETS = COMPETE FOR BREADCRUMBs of CAPITAL

MAINSTREAM ASSETS = LARGE AMOUNT ALLOCATED TO

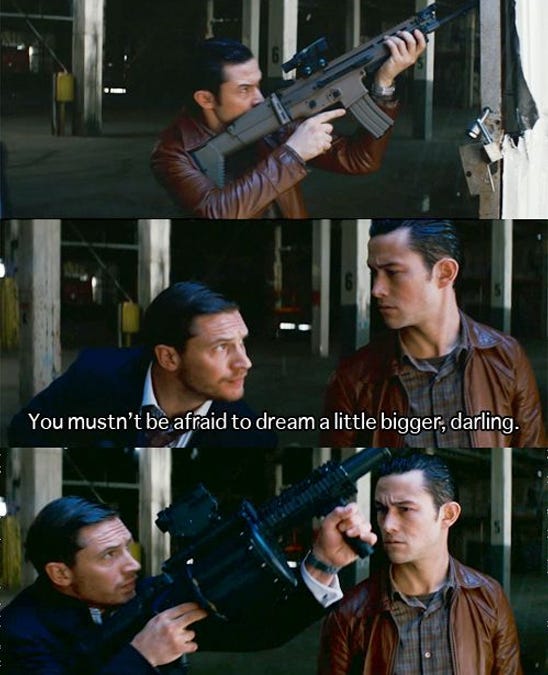

The hsaka meme - YOU MUSTN’T BE AFRAID TO DREAM A LITTLE BIGGER, DARLING

It’s not guaranteed, nowhere close. But the next two years is the first actual shot that we’ve ever had of leaving nichedom behind. Buying bitcoin right now is basically a call option on us branching out and being globally recognized as the hardest money that’s ever existed, an asset that’s out of the governments purview, and whatever other absurd narratives we can craft.

If BITCOIN stay niche forever, this industry prolly stays the same size/shrinks - nothing much really changes. Except becomes more and more irrelevant each year. Less capital will deploy here, industry will become less of a blackhole for raw talent.

If we do cross the chasm, which I think we will - we will rapidly expand, (favorable) regulation will be forced to occur, more capital than we’ve ever seen will be deployed into bitcoin. Every pump we’ve seen thus far will look like ants. We will be calling for 7 digits, not 6.

What do I think - Ive never really bet on losers, nor do I enjoy losing money/wasting my time. Wouldn’t be here still if I didn’t think this industry didn’t pose the highest potential for growth + capital appreciation. Think Bitcoin resonates with every age group + investor type w/ 3 large narratives

An hard asset with known supply/inflation

A bet on technology (digital money)

A check on government power

1,000,000

How about ETH?

Bitcoin has found its own path, it’s time for ETH to lead crypto.

Think ETH only other crypto asset with chance to get an ETF in the next 4 years. ETH will prolly be asset managers bet on the entirety of the crypto space. Maybe will write something on this.

GL VITALIK. Lead us to greatness

How do you think government will respond to Bitcoin’s third use case—check of gov power. Do you think they will continue to fight? Or is blackrock powerful enough that they’ll back down